So you want to use your accounting and financing skills to be your own boss. The good news? Bookkeeping and accounting are valuable skills that not everyone picks up on, and businesses could not survive without them. The bad news? There are a lot of freelancers out there. According to Entrepreneur Magazine, small businesses should outsource their financial tasks until they make $1 million in revenue or have at least 30 employees. Research by the Center for American Progress found that only 3.3 percent of small businesses fall into this category. That means over 96 percent of companies can benefit from your services – restaurants, nail salons, retail stores, you name it. It’s just a matter of knowing how to set up your own business and reach out to potential clients.

1. Choose What Services You Offer

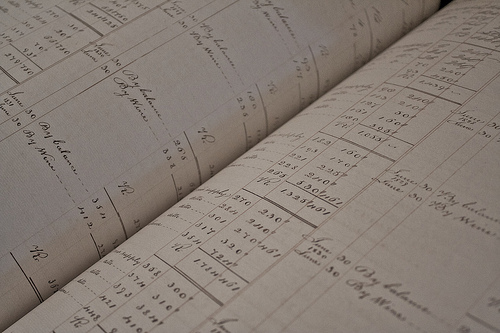

Bookkeeping and accounting are two different things, and in large corporations, they wouldn’t be handled by the same person. Bookkeepers deal with the day to day finances, while accountants look at the big picture – preparing for taxes and audits and understanding the company’s long-term financial future. To stand out as a freelancer, it’s a good idea to offer services not everyone is offering. You should decide right away how much you’re willing to take on – payroll, accounts receivable, financial reports, audit and tax preparation, business plans, or even training on accounting software. How much you’re willing to offer will directly affect how many clients you can handle, but it’s better to offer more and attract better, more stable businesses.

2. Which Clients and How Many?

Another way to stand out from other freelancers is to focus on one particular type of business. If you get really familiar with restaurant accounting, you can focus on just serving restaurants and appeal to owners more than a general bookkeeping and accounting freelancer. You might think this limits your options, but it doesn’t have to. Also, don’t be afraid to offer remote service. Technology can allow smaller businesses to hire you even if you’re not in their city, and balancing off-site clients with bigger ones who want you on-site for a couple days a week is ideal. Don’t take on too many clients at once – wait until you’ve seen what the work load is like. When businesses are growing quickly, they may find they need you there more and more, so don’t be surprised if freelancing turns into full-time job offers.

3. Impress with your Knowledge

You will attract clients if you know the tax laws in and out, know how to use accounting software, and can offer professional credentials. Work on getting your CMA or CPA if you don’t already have them. These certifications will increase your salary and make your services highly marketable. Also think about some of the other certifications you can get, such as the different auditor designations or Fraud Examiner. There are literally dozens of specialties you can add to your list. Not all of these will impress anything close to the way a CPA does, but they can only help expand your business in a highly competitive field. You might be the most brilliant accountant around, but without the credentials to prove it, it’s sometimes hard to get your foot in the door.

Bookkeeping and accounting skills put you ahead of many other people trying to make a living through self-employment. It’s a valuable industry to be a part of, and you should take the time to make your freelance business as exceptional as possible. The more professional you can be, the more professional business owners you will attract. You’ll be able to gain financial freedom through financial knowledge.

Brett Harris is an independent contractor that has an accountant to manage his financial portfolio. If financial management is a career that interest you check out TopAccountingDegrees.org.